There are many ways to support the Ignatian Solidarity Network. Stock gifts, planned giving, or bank transfer are just a few!

Contact Kelly Swan, director of advancement, at (216) 200-4259 or [email protected] with questions or additional giving inquiries. We are grateful for your generosity!

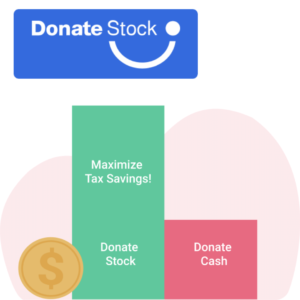

Stock Gifts

How It Works

Did you know that when you donate stock, you avoid the tax on the gain while deducting 100% of the value of the contribution? When you give stock, you may earn 2-3x the tax savings vs. donating cash. It’s a win-win for you and us. And now it’s fast, safe, and easy to do.

Did you know that when you donate stock, you avoid the tax on the gain while deducting 100% of the value of the contribution? When you give stock, you may earn 2-3x the tax savings vs. donating cash. It’s a win-win for you and us. And now it’s fast, safe, and easy to do.

Ignatian Solidarity Network has partnered with DonateStock.com to enable our supporters to make stock donations in 10 minutes or less. Our DonateStock page enables you to donate stock from your brokerage directly to our account through a secure portal, making the gifting process fast, safe, and easy.

So remember, charitable giving doesn’t always mean cash. By giving stock, your support will have an even greater impact – without denting your pocketbook. Give smart and save more by putting stock in something that matters.

Or Make a Stock Gift By Communicating Directly with Our Broker

If you wish to make a stock gift to the Ignatian Solidarity Network, stocks may be transferred to the organization’s account at Legacy Strategic Asset Management of Wells Fargo Advisors LLC:

ATTN: Kimberly Ellis Morgan

Telephone Number: 330-653-8161

Fax Number: 330-655-8921

Deliver to DTC Number: #0141

For credit to Account Number: 5068 1236

Account Name: Ignatian Solidarity Network

Tax Identification Number: 34-2000767

Let Us Know

Kindly inform ISN of any stocks you transfer by contacting Kelly Swan, director of advancement, at 216-200-4259 or [email protected] or writing to:

Kelly Swan

Ignatian Solidarity Network

1 John Carroll Blvd.

University Heights, OH 44118

Questions

For further information, please contact Kelly Swan, at 216-200-4259 or [email protected]. We appreciate your support.

IRA Charitable Rollover

The IRA Charitable Rollover allows individuals age 70 ½ and over to donate up to $100,000 in individual retirement account (IRA) assets to the Ignatian Solidarity Network. The Charitable IRA Rollover is tax-free and not included in a donor’s adjusted gross income.

How it works

Individuals may make gifts to charity from traditional and Roth IRA accounts without any federal tax liability as long as the gifts are “qualified charitable distributions.” No charitable deduction may be taken by the owner, but distributions will qualify for all or part of an IRA owner’s Required Minimum Distribution.

Requirements for “qualified charitable distributions”

- Gifts are tax-free up to $100,000 per year

- Gifts will qualify for all or part of your Required Minimum Distribution

- IRA holder must be age 70 ½ or older at the time of the gift

- Gifts must be outright gifts to a charitable organization

- Distributions may only be made from traditional IRAs or Roth IRAs

Who benefits from this provision?

- People who normally do not itemize their deductions can avoid taking the IRA distribution as income and send it directly to charity. This may reduce both their federal and state income tax liability.

- Individuals whose IRA distributions increase their income to a level where 85% of their social security is taxed may want to make a qualified charitable distribution to reduce their income.

- Individuals in high-income brackets who have large IRAs may have substantial income tax savings not otherwise available because of charitable deduction limitations. A qualified charitable distribution of up to $100,000 may have the three-fold benefit of reducing their taxable income, reducing the value in their IRA, and meeting their Required Minimum Distribution.

This is an excellent opportunity for individuals to fulfill their charitable goals. Transfers from IRAs can fund ISN’s Companeros Fund, Scholarship Funds, and our Endowment.

To transfer a gift from your IRA, please contact your IRA administrator directly. ISN’s Tax Identification Number is 34-2000767.

For more information on how you may benefit ISN through an IRA Charitable Rollover gift, please contact Kelly Swan, director of advancement, at 216-200-4259 or [email protected].

This information is for educational purposes and is not professional tax or legal advice. Consult a financial professional or tax advisor about your specific situation.

Make ISN a Beneficiary

Did you know that the beneficiaries named on a retirement plan or life insurance policy determine who will receive these funds, even if they are designated differently in your will? Did you also know that funds remaining in your IRA may be subject to multiple taxes if left to your estate?

If you are considering including a gift for The Ignatian Solidarity Network in your will, we have a simple solution. Name ISN as a beneficiary or partial beneficiary of your retirement plan and leave other less-taxed assets to your family

IT’S EASY AS 1, 2, 3!

- Request a “change of beneficiary” form from your plan administrator.

- List the Ignatian Solidarity Network as a beneficiary at the following address: 1 John Carroll Blvd, University Heights, OH 44118

- Inform Kelly Swan ([email protected] or 216-200-4259) of your intentions, so we can thank you!